The Two Most Important Habits for Building Wealth and Becoming a Millionaire

Introduction

Building wealth and becoming a millionaire is a dream Habits for many, but few achieve it without intentional effort. Success in wealth creation isn’t just about luck or talent—it’s about adopting the right habits that lead to financial growth and sustainability. Among the countless practices for financial success, two habits stand out as the most crucial: consistently saving and investing and developing a growth mindset.

This article will explore how these two habits work, why they are vital, and how you can incorporate them into your life to achieve millionaire status.

Habit #1: Consistently Saving and Investing

Wealth doesn’t accumulate by chance; it is the result of consistent saving and strategic investing. This habit creates the foundation for financial stability and long-term wealth building.

Why Saving and Investing is Essential

- Saving ensures you have the resources to cover emergencies, seize investment opportunities, and avoid unnecessary debt.

- Investing allows your money to grow over time through compounding returns, turning small contributions into substantial wealth.

The Power of Compound Interest

One of the key reasons investing is so powerful is the effect of compound interest. When your investments earn returns, those returns generate additional returns, creating exponential growth.

For example:

| Years | Initial Investment | Annual Contribution | Interest Rate | Future Value |

|---|---|---|---|---|

| 10 | $5,000 | $5,000 | 8% | $78,227 |

| 20 | $5,000 | $5,000 | 8% | $247,115 |

| 30 | $5,000 | $5,000 | 8% | $611,729 |

The longer you invest, the greater your wealth grows. Starting early and being consistent are key.

How to Build the Saving and Investing Habit

- Create a Budget

Passive voice: Expenses should be tracked, and income should be allocated toward essential categories like savings, investments, and daily needs. - Pay Yourself First

Allocate at least 20% of your income to savings and investments before spending on other expenses. - Use Automated Systems

Automating savings and investment contributions ensures consistency and removes the temptation to skip payments. - Diversify Investments

Investment portfolios should include stocks, bonds, real estate, and other assets to reduce risk while maximizing returns.

Common Mistakes to Avoid

- Not Starting Early: Delays in investing mean losing the benefits of compounding.

- Overspending: Living beyond your means can deplete resources meant for savings.

- High-Risk Investments: Chasing quick returns often leads to unnecessary losses.

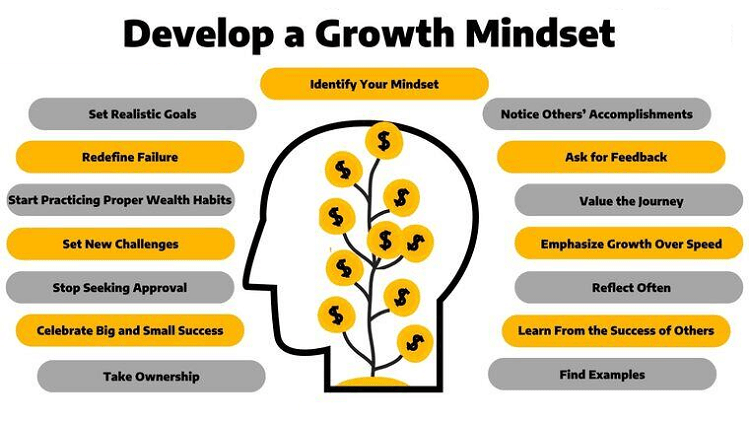

Habit #2: Developing a Growth Mindset

A growth mindset is the belief that skills, intelligence, and abilities can be developed with effort, learning, and persistence. In wealth-building, this mindset plays a critical role in identifying opportunities, overcoming challenges, and continuously improving financial literacy.

Why a Growth Mindset Matters

- Encourages Learning: A growth mindset pushes you to expand your financial knowledge, explore new investment opportunities, and adapt to market changes.

- Promotes Resilience: Setbacks are inevitable, but a growth mindset helps you bounce back and find new paths to success.

- Supports Long-Term Thinking: It fosters patience and the ability to focus on the bigger picture rather than short-term gains.

Characteristics of a Growth Mindset for Wealth-Building

- Adaptability: Being open to change and willing to adjust financial strategies when needed.

- Persistence: Continuously pursuing financial goals despite obstacles.

- Self-Reflection: Regularly evaluating your spending, saving, and investing habits for improvement.

Steps to Develop a Growth Mindset

- Embrace Lifelong Learning

Passive voice: Financial skills should be regularly updated through books, courses, and mentorship. - Set SMART Goals

Specific, Measurable, Achievable, Relevant, and Time-bound goals help track progress effectively. - Seek Feedback

Constructive feedback from mentors or financial advisors helps refine strategies. - Celebrate Small Wins

Acknowledging milestones keeps motivation high and reinforces positive behavior.

Examples of a Growth Mindset in Action

- Investing in financial education through courses or workshops.

- Learning from failed investments and using the experience to make better decisions.

- Taking calculated risks, such as starting a business or diversifying investments.

Table: Comparing Fixed vs. Growth Mindsets in Wealth-Building

| Aspect | Fixed Mindset | Growth Mindset |

|---|---|---|

| Attitude Toward Risk | Avoids risks to prevent failure. | Takes calculated risks to achieve growth. |

| Learning | Believes financial skills are fixed. | Views financial knowledge as expandable. |

| Response to Setbacks | Gives up after failure. | Sees failure as an opportunity to learn and improve. |

| Long-Term Thinking | Focuses on immediate gratification. | Prioritizes long-term goals over short-term rewards. |

How These Two Habits Work Together

The Two Most Important Habits for Building Wealth and Becoming a Millionaire? While saving and investing lay the financial groundwork, a growth mindset ensures continuous improvement and adaptation. Together, these habits create a powerful combination for wealth-building:

- Discipline Meets Adaptability

Consistent saving and investing require discipline, while a growth mindset helps refine strategies over time. - Financial Knowledge and Action

A growth mindset encourages financial learning, and saving/investing ensures that knowledge is applied effectively. - Resilience in Challenging Times

Economic downturns or unexpected expenses can test anyone’s financial stability. A growth mindset helps you adapt, while savings provide a safety net.

Chart: How Saving, Investing, and Growth Mindset Lead to Wealth

Frequently Asked Questions (FAQs)

1. Why are saving and investing so important for wealth building?

Saving and investing ensure that you consistently grow your wealth over time. While savings act as a safety net, investments leverage the power of compounding to multiply your money.

2. How can I start saving and investing if I have limited income?

Start small by setting aside a fixed percentage of your income, even if it’s just 5–10%. Gradually increase this percentage as your income grows, and focus on low-cost investment options like index funds.

3. What is a growth mindset in personal finance?

A growth mindset is the belief that financial skills and knowledge can be developed through learning and persistence. It encourages adaptability, resilience, and long-term thinking.

4. How can I maintain a growth mindset during financial setbacks?

View setbacks as learning opportunities. Analyze what went wrong, seek advice from experts, and adjust your strategy. Celebrate progress, no matter how small, to stay motivated.

5. Can I become a millionaire without adopting these habits?

While it’s possible to achieve financial success through luck or inheritance, consistently saving, investing, and cultivating a growth mindset are the most reliable and sustainable paths to wealth.

6. How do these two habits complement each other?

Saving and investing provide the foundation for financial success, while a growth mindset ensures continuous learning and improvement, enabling you to optimize your strategies over time.

Conclusion

Building wealth and becoming a millionaire is a journey that requires intentional effort and disciplined habits. The two most important habits for achieving this are consistently saving and investing and developing a growth mindset. Together, they provide the tools to grow your wealth, overcome obstacles, and stay committed to your financial goals.

By prioritizing these habits, you can transform your approach to money and pave the way toward a prosperous future. Start today—because the millionaire mindset begins with the right habits.